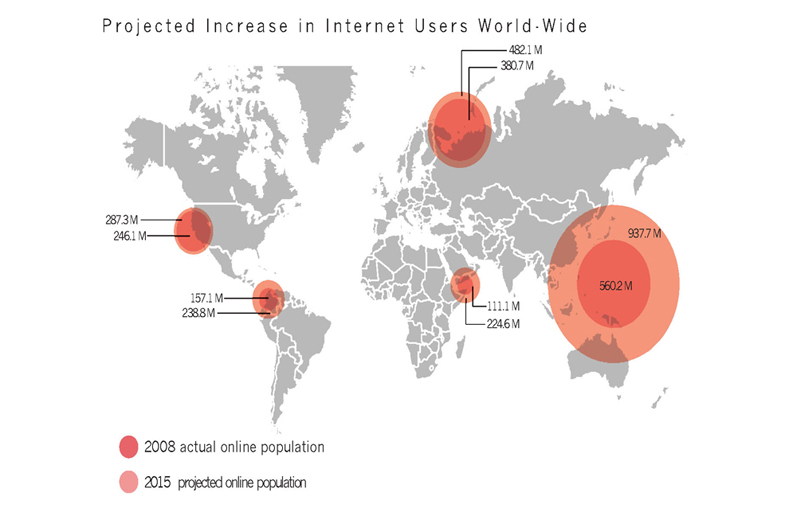

The dematerialized, ethereal space of the Internet today represents an ever-growing presence in the material world, fueled by society’s ceaseless appetite for consumption of data, information and connectivity. As immaterial as it may seem on the screens of ubiquitous electronic devices, the virtual realm of data is inextricably entangled in a symbiotic relationship with its physical analogue. Though many of these infrastructures–which sustain, satiate, and magnify society’s hunger for all things virtual–remain largely unnoticed by the masses, the footprint of virtual space on the physical space is very real. Issues of newly emerging asset classes, property ownership (virtual and physical), urban/architectural morphologies, as well as the environmental impacts of enabling infrastructures all come to the fore with society’s exponentially increasing consumption of information.

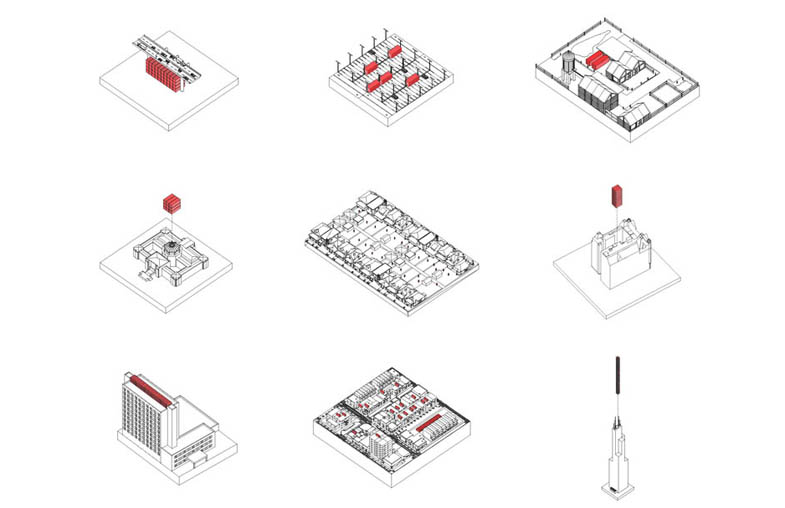

Data affects real estate markets and urban morphologies. High frequency trading represents an automated process of providing liquidity, subdividing orders to maximize market response, and assessing risk. Analyzed through proprietary algorithms and implemented by super computers with the capacity to respond instantaneously (milliseconds) to real-time market behavior, high frequency trading constituted a third of all equity trade volume for EU and US markets in 2006. The necessity to receive the most current and real-time market data has driven investment bankers to move their supercomputers closer to the markets in an attempt to shorten the length of wire and the latency associated to a minimum. As a result, a leasing war has erupted over server real estate hosted by data centers closest to the markets, with each banker seeking advantage through low-latency adjacencies—some times at high (financial and/or legal) costs.

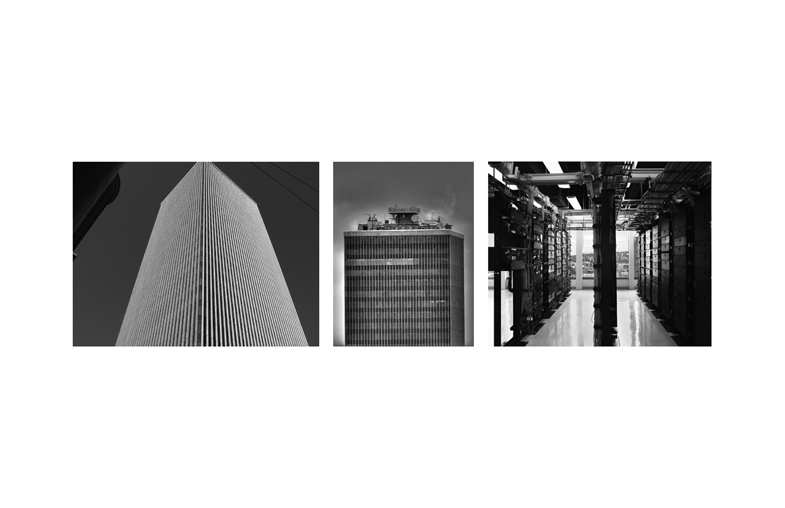

Data affects the environment and ecology. Often unnoticed, data center facilities have been rapidly proliferating in our cities and regional landscapes. Known for their ravenous appetite for power and excessive waste heat output, data centers have the largest carbon footprint of any building found in the city. Fully aware of the operating costs, many tech companies have already opted to build their data centers in the frigid regions of the planet in order to take advantage of the cooling benefits of the comparatively low average annual temperatures of northern countries like Sweden, just below the Arctic Circle. Alternatively, other companies have been forming their own energy subsidiaries to remove the middle man between themselves and energy procurement. In the wake of the escalating growth of the virtual space is the excavation of new relationships to energy and waste within the built environment.

Data affects society’s understanding of ownership. Michael Manos previously of Digital Realty Trust and currently Senior Vice President of Technologies at AOL has called the physical infrastructure of the internet the “Substation of the Future”, and has heralded the emergence of a “Complex Asset Class”. With the growth of large data sets and centralized authority over data ownership, data and the opportunities to monetize its parsing has created a “big data” space race that pushes both virtual and physical infrastructure to its limits. Under the hood, and largely ignored by upper crust engineers is the data center. Buildings filled with computers crunch or store data in ways not un-similar to their Mainframe era brethren. These data centers have proliferated our cities and regions, and obey deployment patterns not obvious to the naked eye.

In collaboration with Laci Videmsky and Casey Elmer